What Is The Amex Airline Fee Credit

Different Amex cards like the Platinum, Business Platinum, and Hilton Aspire all offer an annual $200 airline credit for an airline of your choice. This credit resets on January 1st of each year and any unused credit does not carry over. You either use it or lose it.

You can change your airline selection once per year by either messaging Amex via the online chat or by calling the number on the back of your card. Amex does not enroll you automatically in this benefit so make sure you enroll yourself and pick an airline before doing anything.

On desktop, you can enroll by

- Going to the “More” tab

- Clicking “Rewards and Benefits”

- Clicking “View All Card Benefits”

- Scrolling until you see the $200 Airline Fee Credit

- Clicking “Enroll”

On the mobile app, you can enroll by

- Going to the “Membership” tab

- Clicking “View All” at the Benefits section

- Scrolling until you see the $200 Airline Fee Credit

- Clicking “Enroll”

If you did it correctly, you should see this.

This credit is NOT a flight credit that will reimburse flight tickets but is instead meant to reimburse incidentals like seat change fees, baggage fees, in flight food, etc.

However, there are certain tricks for each airline to help you trigger this credit and extend its use without actually needing to fly. Let’s dive into what works for each airline.

Alaska Airlines

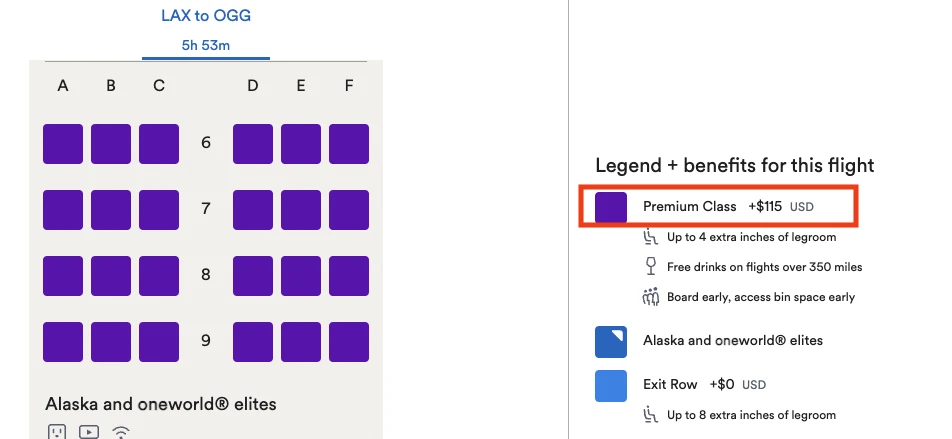

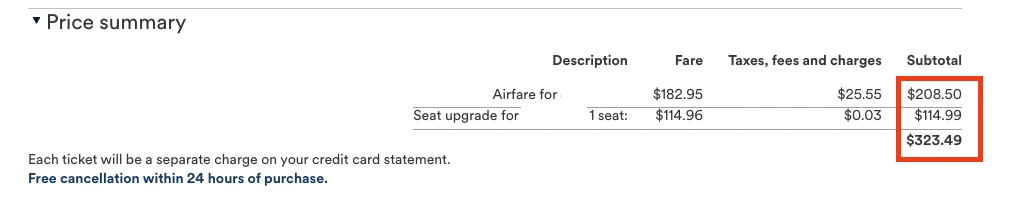

Unfortunately, Alaska Airlines doesn’t have a super straightforward way to trigger this credit. The best way to trigger this credit without flying is to purchase a premium class seat and then cancel the flight for wallet credit after 24 hours. You can purchase the premium class seat at the time of booking or upgrade the seat to premium class at a later time.

The tricky part for this method is finding a cheap main cabin flight that has a premium class fee close to $200. I find that these routes often have a cheap main fare and an expensive premium class seat fare.

- SEA<>HNL/OGG

- LAX<>HNL/OGG

- LAX/SEA<>EWR

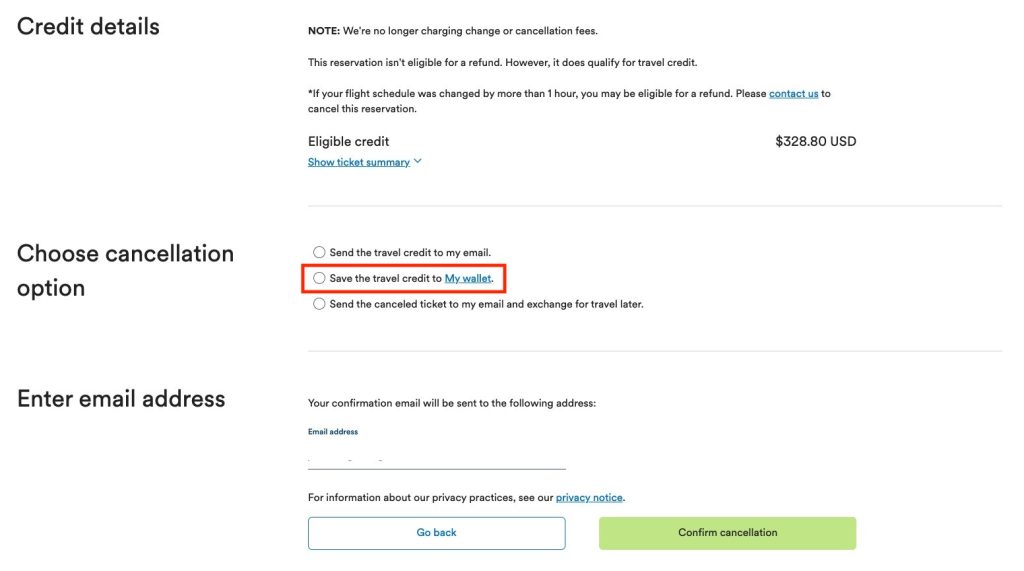

After 24 hours, you can cancel your entire itinerary but make sure that you select the “Save the travel credit to My wallet” option. Once the credit is in your wallet, you can use it to purchase future Alaska Airlines flights. Note that this credit is only valid for 1 year after the day of purchase of the original ticket. You could make the purchase on 10/30 and cancel the trip for wallet credit on 2/10 and your credit would still expire on 10/30 of the next year.

The annoying thing about this process is that Amex rarely recognizes this seat upgrade purchase as a valid use of the credit and usually will not automatically reimburse you for this purchase. Unless the credit magically applies, you will have to wait 14 days and then message Amex explaining that your seat change fee should have triggered the airline fee credit. A good Amex representative can help you apply the credit menu although it may take a few calls/chats before you find someone who can do it.

If you understandably don’t want to go through this process, purchasing an Alaska Lounge membership will also work to trigger this credit.

American Airlines

American Airlines has no worthwhile way of converting the airline credit to a travel credit for use later. There are reports of purchasing a cheap flight then changing it to a more expensive flight that costs <$50 more and paying the fare difference with your Amex card to get the credit. You would cancel this new flight for travel credit but you would be paying a lot upfront each time for only $50 in credit.

Assuming that you buy $100 initial flights and pay a fare difference of $50, you would need to do this book and cancellation trick a minimum of 4 times to get the full $200 and you would end up with around $600 in flight credit. That’s a lot of extra unnecessary funds tied up in a single airline, so this method isn’t ideal for most people.

The reliable ways for using the airline credit for American Airlines are buying Admirals Club day passes, an Admiral Club membership, or buying food and drinks inside an Admirals Club.

Delta Airlines

The method for triggering the airline credit for Delta is very specific so it’s important to get the steps correct. You must either pay for a new flight with a split tender payment method or change an existing flight to a more expensive one.

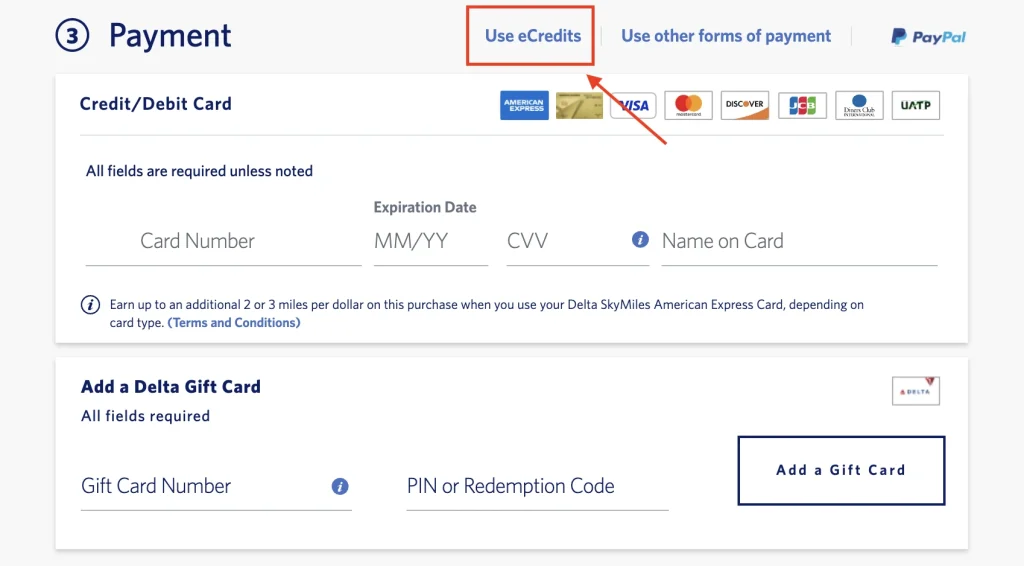

If you have a gift card, eCredit, or voucher already in your account, you can purchase a flight with a combination of one of these payment methods and your Amex card. Doing it this way will trigger the airline fee credit if the amount charged to your Amex is equal to or less than $250. However, there’s no real reason to go above $200 since that’s the maximum airline credit amount.

As an example, if you have an existing $50 eCredit and you buy a $200 airline ticket where you charge the remaining $150 to your Amex card, you will get $150 reimbursed. The ideal situation is to find a flight that costs as close to $200 after subtracting away the amount of the credit or gift card you will be using.

The nice thing is that you can purchase a $50 e gift card online if you don’t have an existing credit or gift card already in your account.

The alternative way to trigger this credit is to change an existing flight to a more expensive flight and pay the price difference with your Amex card. For example, if you had a $400 flight and changed it to a $600 flight and paid the $200 fare difference with your Amex card, that $200 would get reimbursed.

If you don’t already have an existing flight, you can purchase a cheap one way flight in main cabin. It’s important to purchase in main cabin so you don’t incur any cancellation fees later on if you decide to cancel it for eCredits.

Once the amex airline fee credit has posted to your Amex account, you can cancel this booking for Delta eCredit which can be used towards a future flight. Note that eCredits expire 1 year after the date of the original booking.

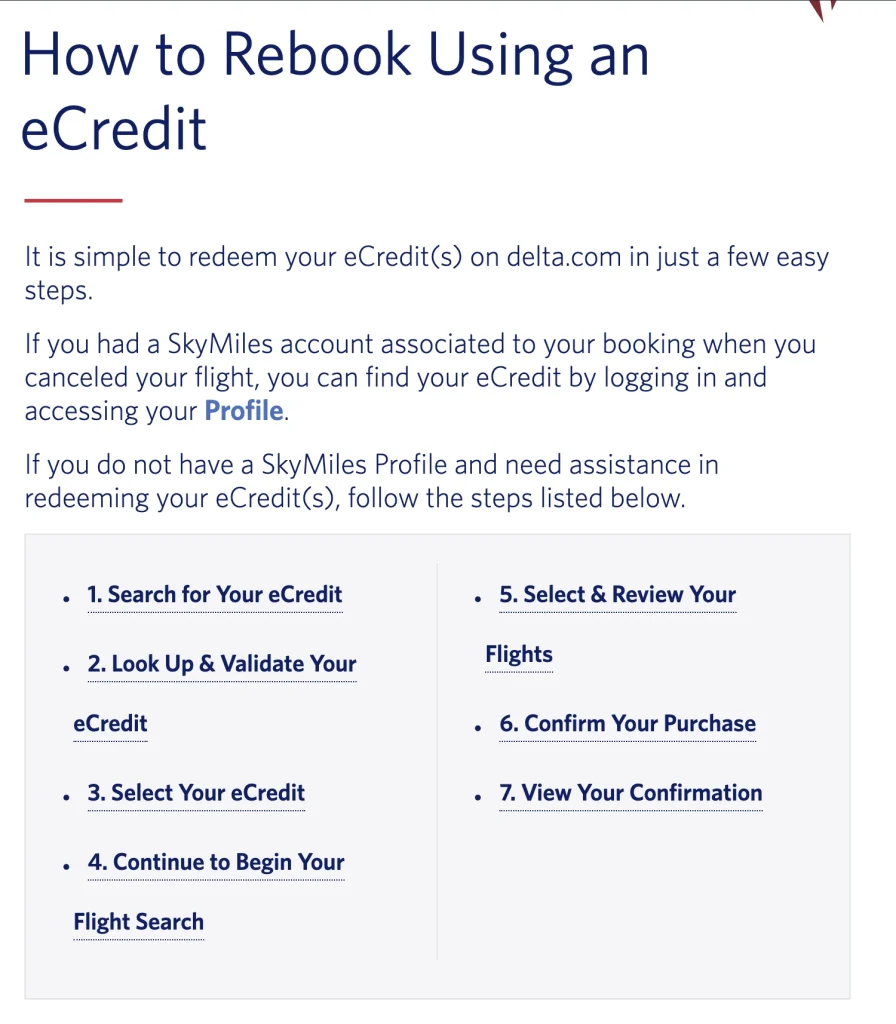

Delta provides a really thorough guide on how to redeem eCredits on its website.

Hawaiian Airlines

Hawaiian Airlines does not have a workaround for triggering the fee credit that doesn’t involve flying. If you’re ok with flying, there are reports that one way tickets <$50 and the taxes of an award ticket costing <$25 will trigger the credit.

JetBlue Airways

JetBlue flight tickets can trigger the Amex airline fee credit but there is not a consistent threshold for what price point will trigger the reimbursement. Some data points indicate the maximum cost of a ticket can be ~$150 but I think it’s safer to find a ticket costing less than $100. However, there’s still no guarantee that the credit will trigger.

If the credit does trigger, you can cancel the ticket for travel credit to be used for a later flight. Note that the travel credit expires 1 year from the date the original booking was made.

Spirit Airlines

Unfortunately for Spirit, there isn’t a good way to trigger this credit without actually flying. The best you could do to get reimbursed is to buy an annual Savers Club membership for $69.95 or upgrade an existing flight to Big Front Seats.

Southwest Airlines

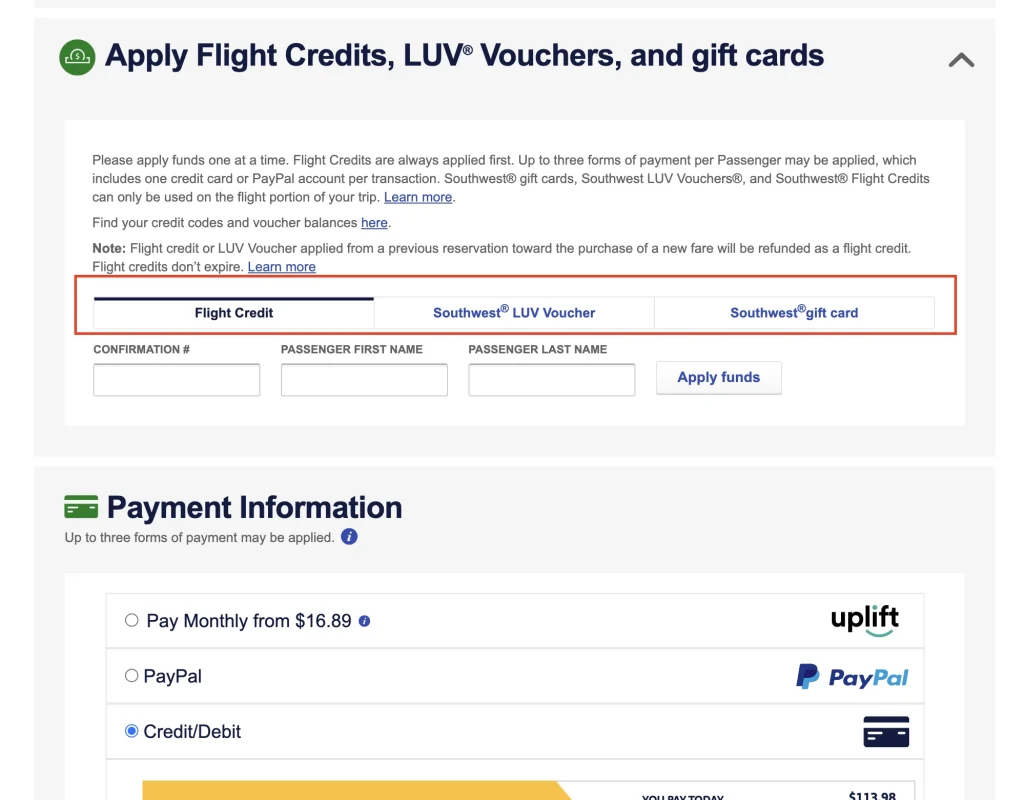

Southwest Airlines will reimburse flight tickets where the total cost is less than $109. If a flight ticket costs more than $109, you can use any gift cards in your account to lower the charged amount to less than $109 and then charge the final amount to your Amex card to trigger the credit.

After you’ve purchased the flight, you can cancel the flight for Flight Credits that will never expire. You can use these flight credits to purchase future Southwest flights.

If you want the flexibility of being able to transfer the Flight Credit to another account, you must buy a Wanna Get Away Plus or higher fare class.

PRO TIP: If you have multiple flight credits, you can use up to 3 of them in a single flight purchase and then cancel it for a single, consolidated flight credit. For example, if you have 3 $50 flight credits, you can purchase a $150 flight using those 3 credits and then cancel that flight for a single $150 flight credit. You do this multiple times to consolidate any credits you have.

United Airlines

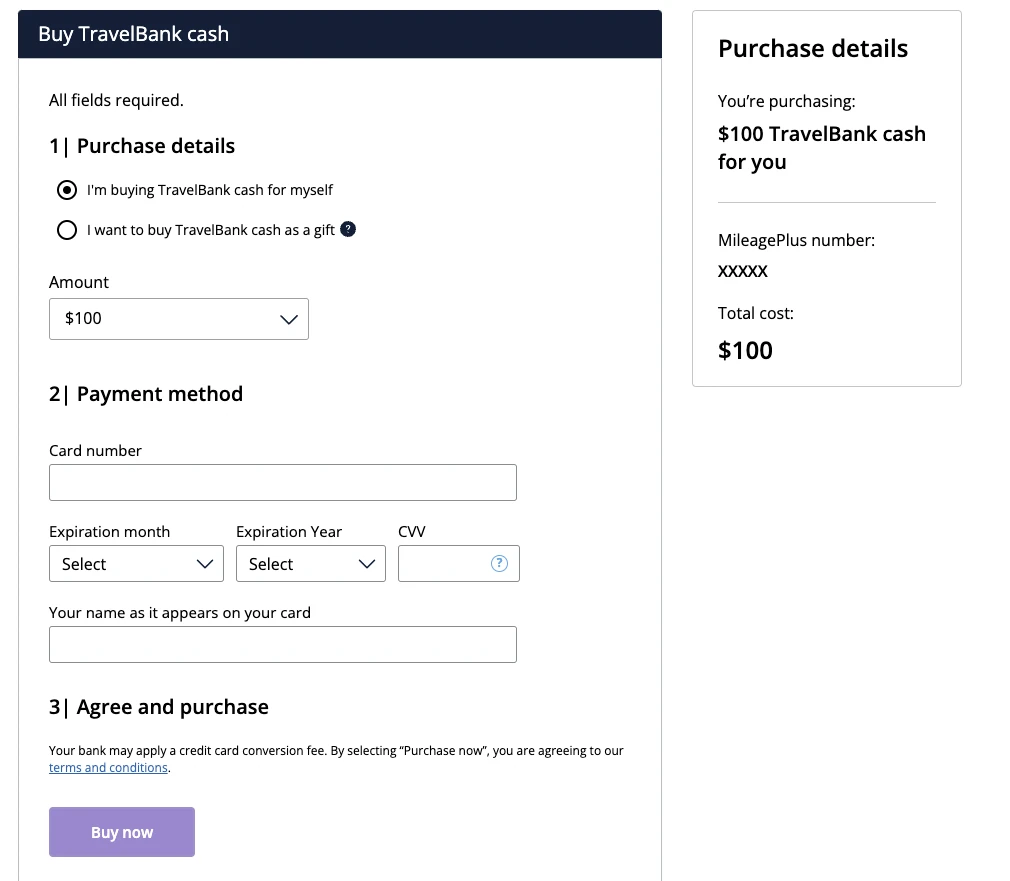

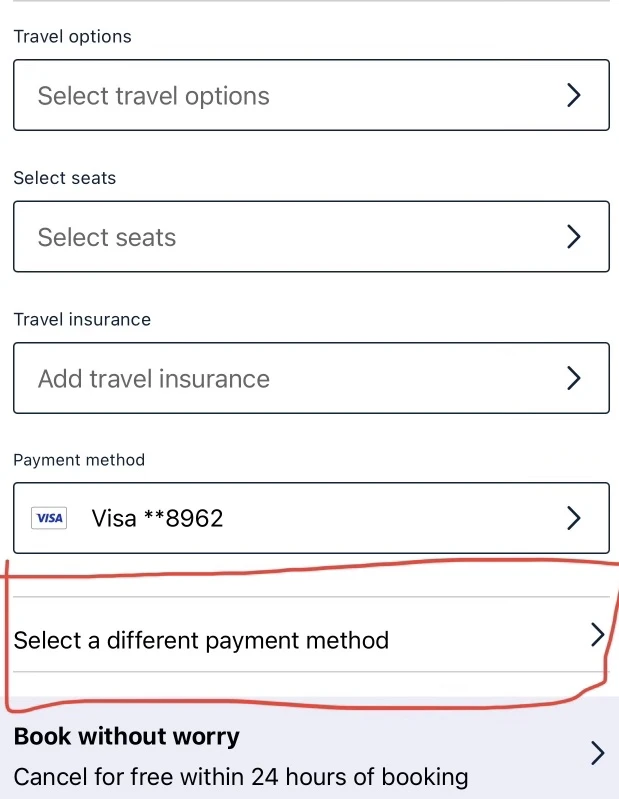

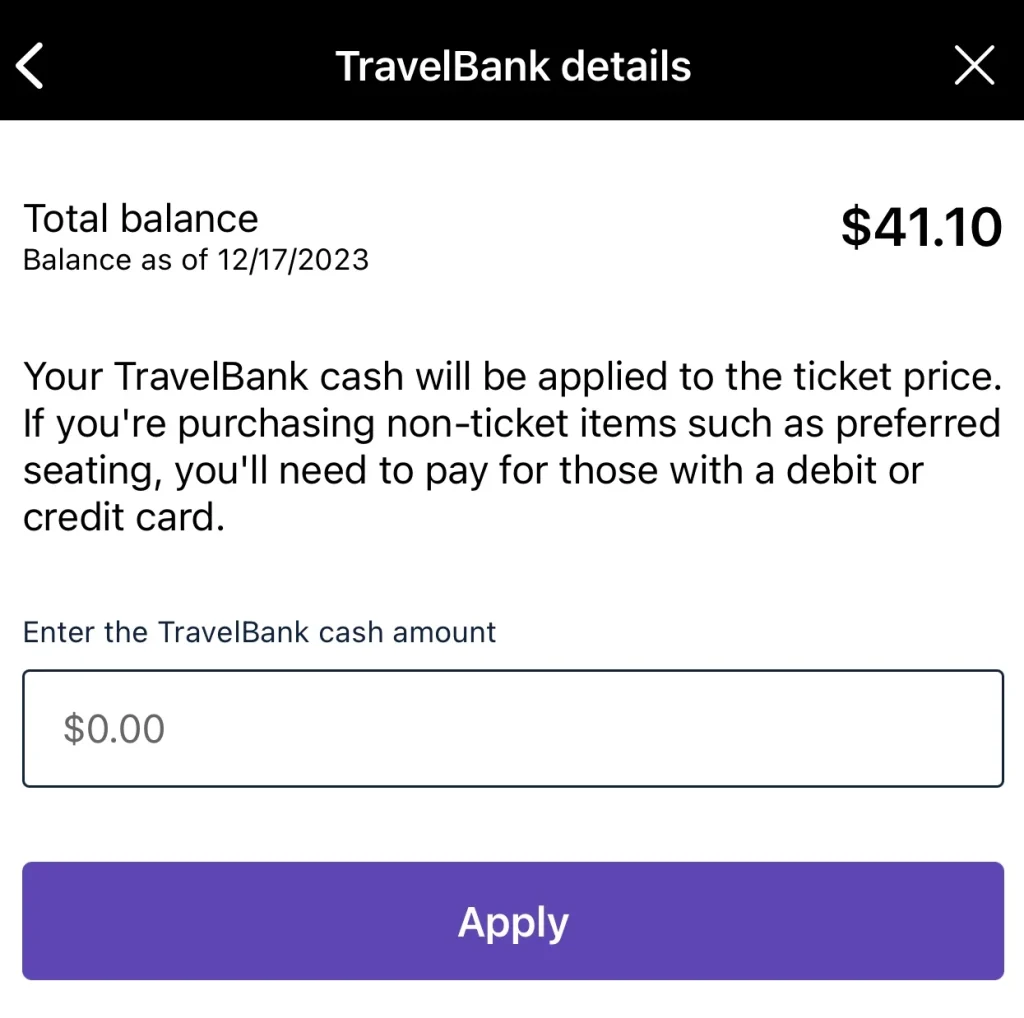

United Airlines is the easiest airline to take advantage of this airline fee credit. You can simply go to United Travel Bank, select the “I’m buying TravelBank cash for myself” option, and purchase 2 $100 travel bank credits. You need to purchase 2 $100 since there is no $200 increment and there’s no point choosing the $250 option and adding an additional $50 to your United account unnecessarily.

These travel bank credits will expire 5 years after the date of purchase and can be applied to any future United Airlines ticket purchases. You can think of them as United Airlines gift cards.

Important Things To Know

The most important thing about all of these methods is that YOU SHOULD NEVER CALL/CHAT AMEX ASKING ABOUT WHY THE METHOD DIDN’T WORK. The Amex representatives are not trained to know these methods and will instead deny that these are eligible ways of using the credit. The worst case scenario is that they escalate the issue and the method gets shut down. In order to preserve these methods, you should NOT explicitly mention them to representatives.

It is also crucial to understand that these credits do not post immediately. A good rule of thumb is to wait 10 days to see if the credit shows up in your account. Oftentimes, the credit tracker, which shows how much of the $200 you have spent so far, will get updated before the actual credit appears in your account. You can check that to see if the charge was successful in triggering the credit.

Conclusion

The Amex airline credit can be a pain to use but there are some useful tricks to help you extend that credit. United, Southwest, and Delta are the airlines with the most straightforward and reliable ways to redeem this credit. If you have not switched your airline of choice at all this year, it’s worth contacting Amex to switch your airline to one of these 3 and using the methods above to not miss out on your annual airline fee credit.

It’s as if you read my mind; you seem to know so much about this that it’s as if you wrote the book in it or something. Although I believe a few images would help to drive home the point a bit more, this is an outstanding site. I will definitely be back.