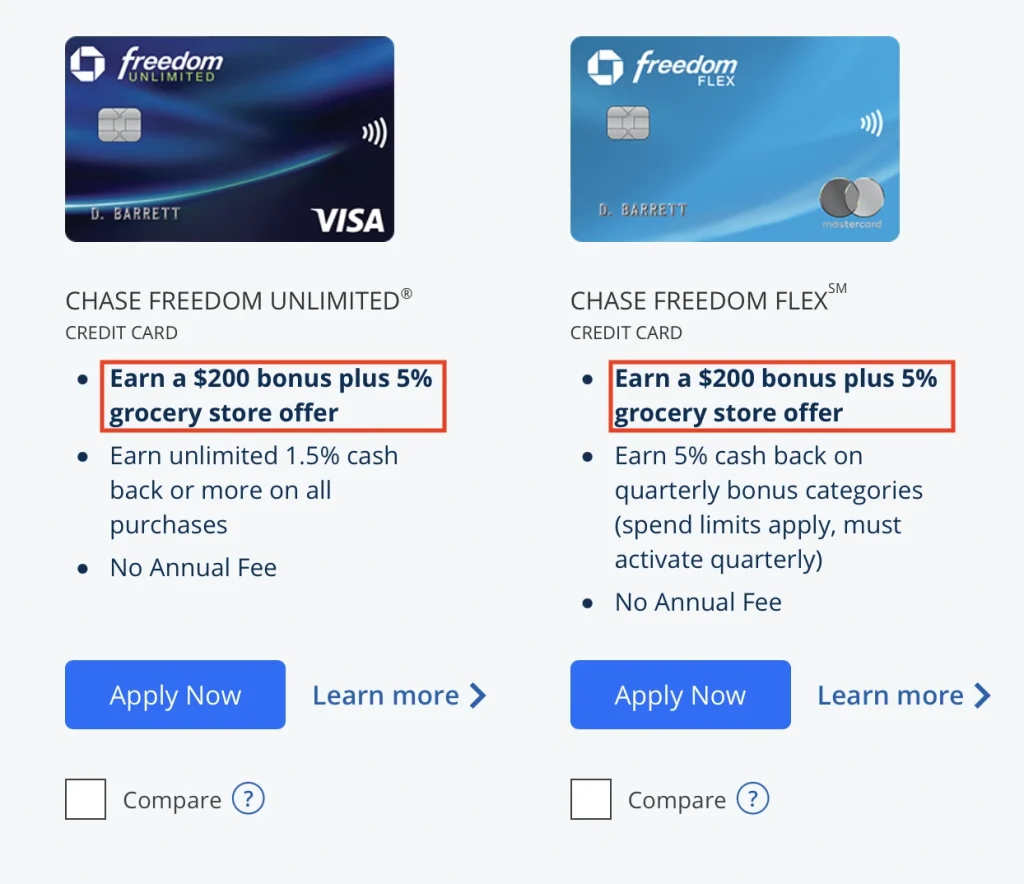

Overview Of The New Chase Freedom Offer

This new offer on the Chase Freedom Unlimited and Chase Freedom Flex gives you $200 back + 5% on grocery and gas purchases for the first year up to $12,000 in combined purchases.

Lately I’ve been seeing a lot of strong interest in this offer and people hyping it up to be something amazing. I do agree that this is an improvement over the old offer but I still think that this new Chase Freedom offer is not worth it. Overall, the Chase Ink Unlimited is still a better option but this new offer does make the winner less obvious. So I wanted to do a quick comparison to see how they fare against one another.

How To Get The New Offer

I actually had a little trouble getting this offer to show up since it’s not guaranteed to show up at a specific link. There can be different variations of this offer that show up on your screen so make sure that what you see is the $200 + 5% back on grocery and gas purchases offer.

I initially went to this link in Chrome and only saw the $200 back offer. Even loading the same page in incognito did not yield the desired offer. I then tried Firefox and this time saw the $200 offer + 5% in gas purchases. After that, I opened the link again in a private Firefox window and this time saw the $200 offer + 5% in grocery purchases lol. It wasn’t until I used Safari and opened the link that I was finally able to see this new Chase Freedom offer.

It seems to be pretty random what offer gets shown on your screen so just try refreshing a couple times or using incognito or a different web browser to see if that gets the new offer to show up.

Chase Freedom Unlimited Vs. Chase Ink Unlimited

There are 2 main reasons why the Chase Freedoms in general are inferior to the Chase Ink Unlimited

- A new freedom will take a 5/24 spot

- The SUB is not as good as the Chase Ink Unlimited

The Chase Ink Unlimited (CIU) and the Chase Freedom Unlimited (CFU) are pretty much the exact same card since they both earn an unlimited 1.5% back on all purchases. The only difference is that the CIU is a business card and the CFU is a personal card.

Since the CIU is a business card, this means that you can apply for the CIU and get all the benefits the CFU offers without having to sacrifice a 5/24 slot. 5/24 slots are very precious and you should be strategic in how you use them. You can check out our best credit cards page for a list of good cards with a better SUB that are worth a 5/24 slot.

In addition to this, the CIU has a much larger SUB at 75,000 points after $6,000 in spend where as the CFU (normally) only has a SUB of 20,000 points after $500 in spend. Even if you were the max out the full $12,000 at 5% on grocery and gas purchases, your net UR earned would only be 65,000 UR (20,000 SUB + 12,000 grocery or gas spend * 5).

Compare this to the CIU SUB which would give you a total of 84,000 UR (75,000 SUB + 6,000 spend * 1.5). For half of the total spend required, we get 19,000 more UR. This isn’t even considering the fact that the $12,000 in spend is more efficiently spent opening 2 Chase Inks and spending $6k on each to get a total of 168,000 UR.

Chase Freedom Flex Vs. Chase Ink Unlimited

While the CIU is the clear winner over the CFU, the Chase Freedom Flex (CFF) has a little bit of a stronger argument and has a more interesting comparison.

In the best case scenario, if you were to max out the $1500 quarterly categories and have the gas and grocery bonus overlap with 2 of those quarters, your net UR would be 92,000 UR. The math is as follows: 20,000 SUB + (1500 quarterly spend * 9) * 2 + (9000 gas or grocery spend *5). The 9x multiplier comes from the 5% quarterly bonus plus the additional 4% bonus from the SUB offer. The SUB offer accounts for the base 1% earn on the card in the calculation for 5% so it will only stack an additional 4%. The 9000 is just the leftover $9000 from the 12k in gas/grocery spend after spending $3000 on the two quarterly categories.

The total UR earned here is actually more than the total UR earned from the CIU. But this is still at the expense of a 5/24 slot and assuming that you’re only opening 1 card. If you’re getting multiple Inks like mentioned above, the combined UR earned from the Inks is still more than the CFF offer.

Conclusion

In my opinion, the Chase Ink Unlimited is still better than both the Chase Freedom Unlimited and the Chase Freedom Flex even with their new elevated offers. The only reason I can think of recommending the CFU or CFF over the CIU is if you are unable or unwilling to get business cards. Check out our guide on business cards if you’re hesitant or want to know more about business cards. Let me know your thoughts on the new offer!